Mining technology company Lithos Group Ltd. (LITS:CBOE.CA;LITSF:OTCMKTS;FSE:YU8;WKN:A3ES4Q) has been selected by the Chilean National Mining Company (ENAMI) to participate in the proposal phase of its direct lithium extraction project.

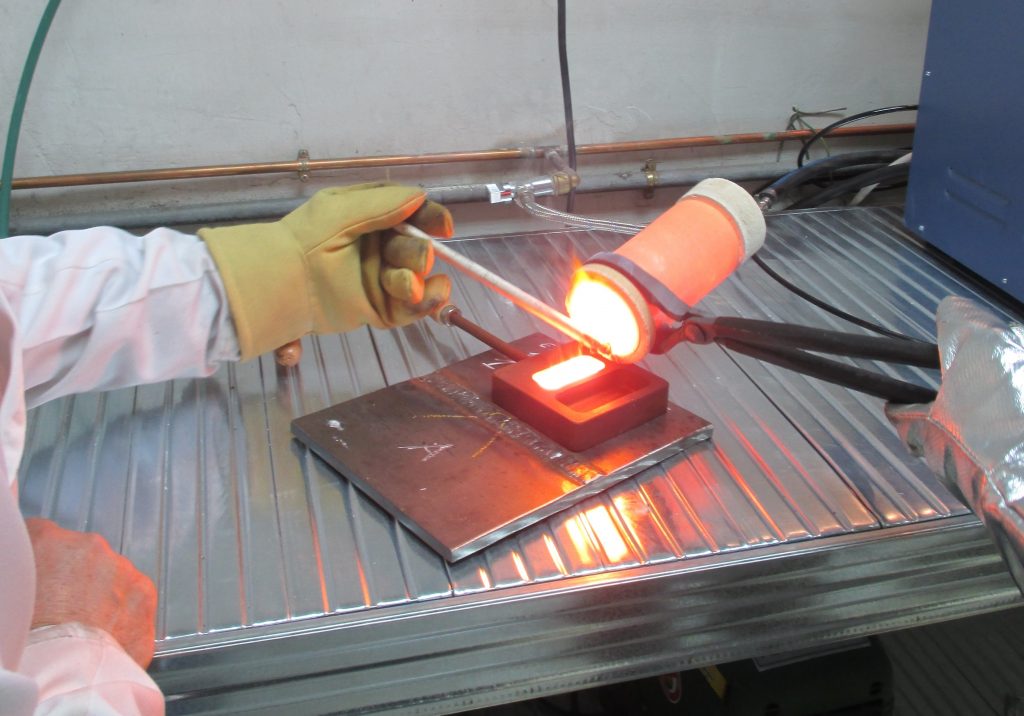

ENAMI issued a global request for information (RFI) for the project to a selected group of DLE technology leaders globally, including LiTHOS, to determine the best possible technology for its Chilean assets. Lithos showcased the application of its AcQUA™ technology — which allows lithium to be extracted from brine without using water-intensive, environment-damaging evaporation ponds — for the High Andean Salt Flats in the Atacama region.

ENAMI has still not selected an institution to perform laboratory tests with brine samples from the project site. Results from laboratory tests with brine samples from the project site will be evaluated, along with those of a select few vendors who were invited to ENAMI's technology screening process.

"LiTHOS Technology is pleased to participate in the RFI process, aligning with ENAMI's efforts to explore sustainable mining technologies. Given our experience and demonstrated success processing Chilean brines, we were grateful to be provided this opportunity to provide ENAMI with a detailed description of the capability of our AcQUA™ technology. ENAMI is taking a leadership role in the Chilean Lithium industry and represents a critical strategic customer for our AcQUA™ technology. The purpose of this RFI process is to develop a short list of ENAMI approved technologies which will be deployed on all future projects. We look forward to an opportunity to prove our AcQUA™ technology and become an ENAMI approved technology partner," said Scott Taylor, chief executive officer of Lithos.

Headquartered in Denver, Colorado, Lithos Group aims to "become the global standard in economically efficient, sustainable lithium production," the company said.

AcQUA™ spans the whole value chain from the conditioning and pretreatment of raw brines, the primary bottleneck, through the direct lithium extraction (DLE) phase to the polishing and purification of battery-grade lithium feedstock. About 70% of global lithium resources are hosted in brine.

Technical Analyst Clive Maund recommended the stock for "immediate purchase" last month after news broke that the company had commenced building a demonstration-scale modular field unit for two Tier 1 lithium producers using AcQUA™.

Technical Analyst Clive Maund recommended the stock for "immediate purchase" last month after news broke that the company had commenced building a demonstration-scale modular field unit for two Tier 1 lithium producers using AcQUA™.

Maund said the stock was "shaping up for a major bull market."

"This is a big, big deal, for the implementation of Lithos Group's technologies will greatly reduce the threat of contamination by toxic chemicals, massively reduce costs and production time, and as it will largely reduce the use of evaporation ponds, it will slash water consumption dramatically," Maund wrote of Lithos' technology.

"By its very nature, lithium occurs and is produced in arid regions of the world where there is fierce competition for water resources that often becomes a political issue, so the vast reduction of water consumption made possible by Lithos Group's technologies will make it much more possible for lithium producers to work unhindered by friction with locals over water that could lead to serious complications," Maund wrote.

The Catalyst: Boosting Lithium Recoveries

The AcQUA™ modular field until is scheduled for factory acceptance testing in July. Once the system passes factory acceptance testing, it will immediately be deployed to the field for site acceptance testing, Lithos said.

That testing requires 1,500 hours (or about 2.5 months) of operational performance validation with each customer.

"The technology enables lithium brine resource operators to deploy field-ready extraction solutions that will substantially reduce water consumption by recycling upwards of 98% of the input brine water, boost existing production by up to 300% with optimal re-injection, curtail the use of toxic chemicals, cut processing time by more than 90% and substantially eliminate the use of evaporation ponds in the pretreatment and concentration phases of production," Beacon analyst Ahmad Shaath wrote in a January research report.

As for DLE, it could nearly double the production of lithium from brine, Goldman Sachs analysts wrote in a research note. It could boost recoveries to 70−90% from 40−60%, thereby improving project returns.

Lithos has two fully operational facilities, a 4,000-square-foot laboratory in Denver, Colo., and a 55,000-square-foot complex that enables an expansion for the company, permitted to produce pilot-scale lithium hydroxide in Bessemer, Ala. In January, Lithos subsidiary Aqueous Resources applied for a follow-on US$30 million grant from the U.S. Department of Energy (DOE) to expand the Alabama facility. Awardees will be announced this May.

Demand for Element Steadily Rising

An important component of electric vehicle (EV) batteries, lithium is also used to strengthen alloys, as a high-temperature lubricant, and as a drug to treat bipolar disorder.

Demand for the element has been rising steadily since 2020 and is expected to continue until at least 2035, Statista data show. Projections indicate that by then, demand will have reached 3,829,000 metric tons of lithium carbonate equivalent, a 317.5% increase from 917,000 metric tons in 2023.

Similarly, the lithium market is projected to continue growing to US$6.4 billion in value by 2028 from US$2.5 billion in 2023, according to Markets and Markets. This change reflects a 20.4% compound annual growth rate (CAGR).

Streetwise Ownership Overview*

Streetwise Ownership Overview*

Lithos Group Ltd. (LITS:CBOE.CA;LITSF:OTCMKTS;FSE:YU8;WKN:A3ES4Q)

"The market has observed stable growth throughout the study period and is expected to continue with the same trend during the forecast period," the report said.

Katusa Research purported the lithium market could have a major breakout this year, citing its use in EVs and storage batteries as key drivers.

"The opportunity in lithium is more electric than ever," Katusa wrote.

Ownership and Share Structure

About 60% of Lithos is held by insiders and management, the company said. According to Reuters, this includes CEO Scott Taylor with nearly 15% or 12 million shares, Independent Director Michael Westlake with 0.73% or 1.6 million shares, and Independent Director Kevin McKenna with 0.05% or 40,000 shares.

About 27% of the company is held by strategic entities. The rest is retail.

Lithos has a market cap of CA$49.04 million with about 83 million shares outstanding. It trades in a 52-week range of CA$0.98 and CA$0.51.

| Want to be the first to know about interesting Cobalt / Lithium / Manganese investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Lithos Group Ltd. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000. In addition, Lithos Group Ltd. has a consulting relationship with an affiliate of Streetwise Reports, and pays a monthly consulting fee between US$8,000 and US$20,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Lithos Group Ltd.

- Steve Sobek wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.